Companies that do business across state lines are beginning to wade through the complexities of the standard set by the South Dakota v. Wayfair, Inc., decision.

Companies that do business across state lines are beginning to wade through the complexities of the standard set by the South Dakota v. Wayfair, Inc., decision.

As a seller, you’ll now be subject to the tax laws of each state you sell goods or services in, a complete reversal of the previous rules. Adding to the complexity, each state has different thresholds and rules by industry and product. This likely means that no two companies will be affected in the same manner.

As most states are expected to outline similar rules for how they charge and enforce sales tax before the end of 2019, it’s critical to understand the implications for your business now—especially if you’re a service provider or you operate remotely.

Prior to the ruling, the sales tax compliance burden could be controlled by limiting activities in certain states, and sellers without a physical presence in a state didn’t need to incorporate sales tax into their transactions. Now, sellers need to consider the potential tax implications of each state they do business in.

There are two main things to take into consideration when beginning to calculate your potential tax burden:

- Economic nexus by state

- Roll-on dates

Nexus by State

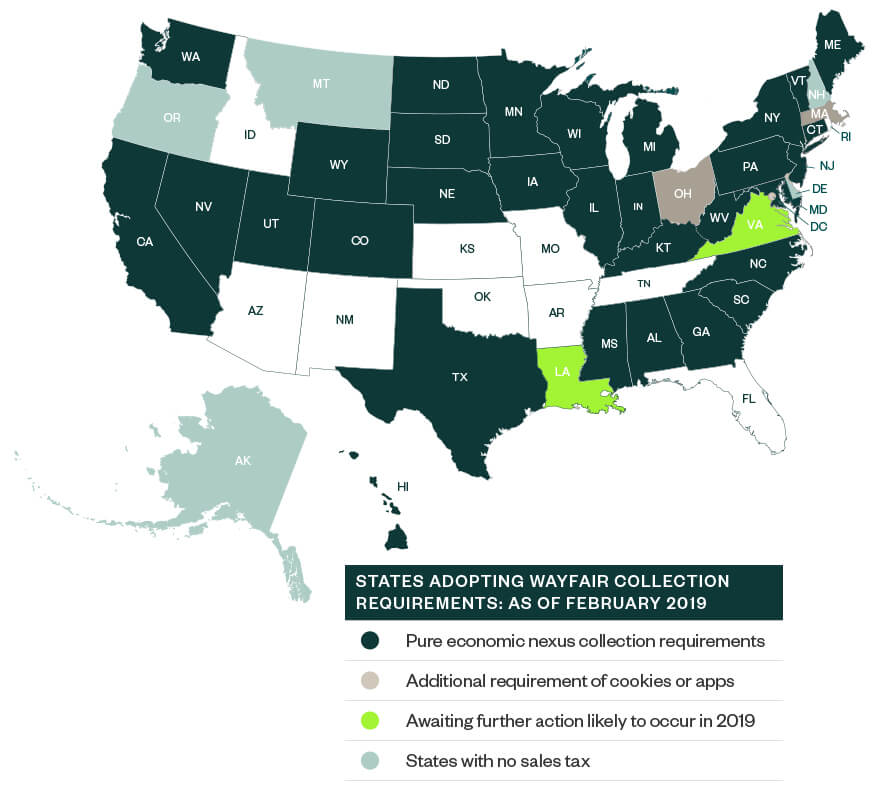

The Wayfair ruling replaced the previous physical presence nexus standard with an economic threshold. Although the court did not lay out a specific threshold, it approved South Dakota’s standard of $100,000 gross retail sales or 200 separate transactions.

The court’s approval of this standard allowed states to enact similar laws with varying thresholds and stipulations. For example, some states have thresholds as high as $500,000. Other states have either avoided or dropped the number of transactions threshold. These laws will likely continue to change and bear watching.

If you’re now considering sales tax implications of a particular state, it might be challenging to decipher if your business is likely to exceed that state’s threshold with varying rules and roll-on dates.

Established and Proposed States

Thirty-four states have already established an economic nexus, and most states are expected to follow by the end of 2019. In December of 2018 and January of 2019 alone, California, Texas, Pennsylvania, and New York all announced their adoption of Wayfair standards. Louisiana has announced and withdrawn a Wayfair standard, but is expected to readopt a modified standard.

The below map illustrates which states have either enacted an economic nexus or are in the process of doing so. When considering their potential sales tax burden in a particular state, you need to consider state rules as well as your amount of revenue and number of sales.

Cookie States

Ohio and Massachusetts took a slightly different approach to establishing economic nexus, opting instead to enact a so-called cookie nexus.

This term refers to a standard where businesses using cookies for web tracking or mobile applications are considered to have a presence in the state. These states both set the threshold at $500,000 in sales, but the biggest impact of a cookie nexus is a pre-Wayfair roll-on date. Now, there’s a longer period of time for a company’s sales to accrue a tax obligation.

A state’s cookie nexus standard has far-reaching implications, especially for a company doing business online, as cookie usage is almost ubiquitous for online retailers and many technology companies. Companies using cookies and doing business in these states will need to assess their sales and plan carefully to help address their tax burdens.

Potential Amendments

Although further legal challenges are unlikely, some states may consider modifying their thresholds to accommodate larger economies, or may eliminate the number of sales threshold altogether.

Roll-On Dates

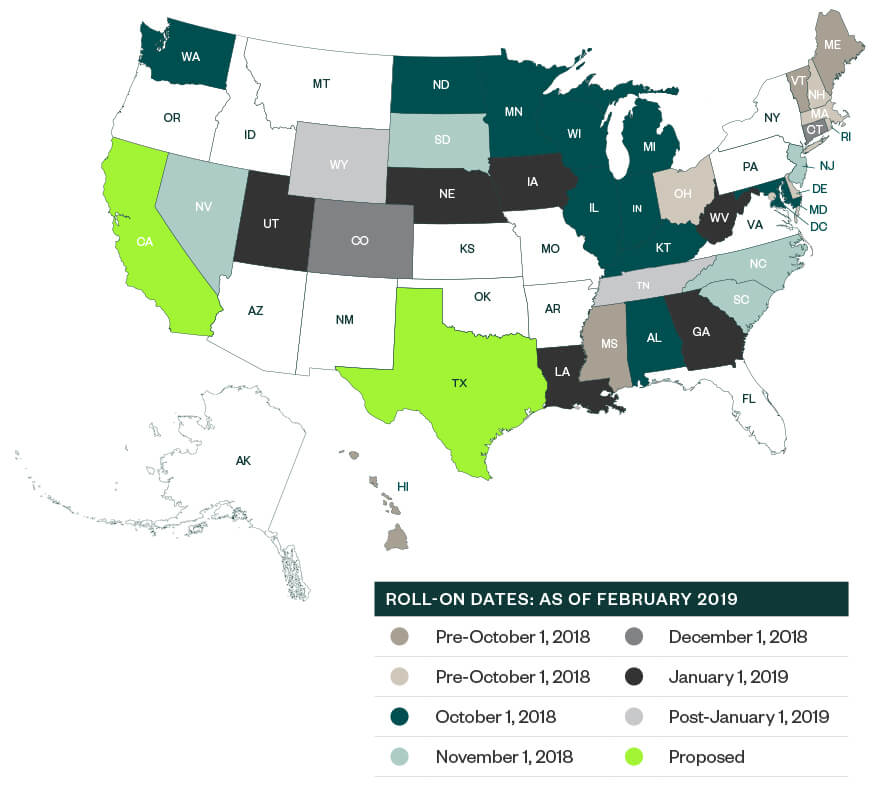

The other major consideration is each state’s roll-on date, which is when these laws begin to apply—not the date they were enacted. The Wayfair decision dictated that the rules couldn’t be applied retroactively, meaning previous sales aren’t subject to taxes within a state.

However, a company could theoretically already owe sales tax in a state with an established economic nexus, provided it already hit the threshold and is past the roll-on date. These dates vary by state and add to the complexity of calculating a potential sales tax burden.

The map below shows the roll-on dates for each state with an established economic nexus.

It’s not yet clear how states will go about enforcing these new rules, but these dates are important. Companies that haven’t registered and set up a system to begin collecting sales taxes on their transactions could potentially be subject to back taxes.

Here are some steps to help you avoid being penalized:

- Register your business where appropriate

- Know if your business exceeds the state thresholds

- Equip your company to properly calculate and charge sales tax on transactions

Compliance

Whereas insulating yourself from the obligation of collecting sales tax used to be relatively easy, the new rules essentially eliminate that opportunity. As your business approaches the standard threshold of $100,000 in sales, consider thinking about collecting and settling sales tax.

If your business operates in many different states, factor in each state’s rules and your company’s sales volumes. The best time to begin planning is now, especially as roll-on dates draw near. The longer you wait, the more potential for increased penalties.

We’re Here to Help

Understanding your sales tax obligations in light of the recent Wayfair decision can be complicated for companies selling goods or services across state lines. To understand how your business might be affected and how to calculate your tax burden, contact your Moss Adams professional.